Second Layer Solutions and the Next Wave of Innovation

Necessity is the mother of invention. In 1991, a group of researchers in the computer laboratory at the University of Cambridge shared a single coffee pot. The problem is that the coffee didn’t last long once brewed, and there was no way to know if there was coffee to be had before making the trek to the machine. A simple solution was to point a camera at the pot and broadcast the frame grabber to all the researchers’ desktop computers through their internal network. Information asymmetry solved.

A couple years later, once technology evolved to allow the images to be broadcast on the Internet, the Trojan Room coffee pot became perhaps the first webcam in the world.

A camera pointed at a coffee pot seemed like a trivial application at the time. But eventually the transmission of live video allowed for large successful businesses to be built, such as Skype and other video conferencing applications. As Chris Dixon once wrote, “The next big thing will start out looking like a toy.”

While transmission of video is now well established, we are still in the early innings of the transmission of value.

Bitcoin has commonly been characterized as a digital commodity, but it has the potential to be more.

With the advent of the Lightning Network, many payment-friction use cases are relieved and new business models are being developed to utilize the enhanced capabilities. The Trojan Room coffee pot reminds us that huge use cases can emerge from humble beginnings.

In this article, we take a look at a couple of the most promising directions for second layer solutions.

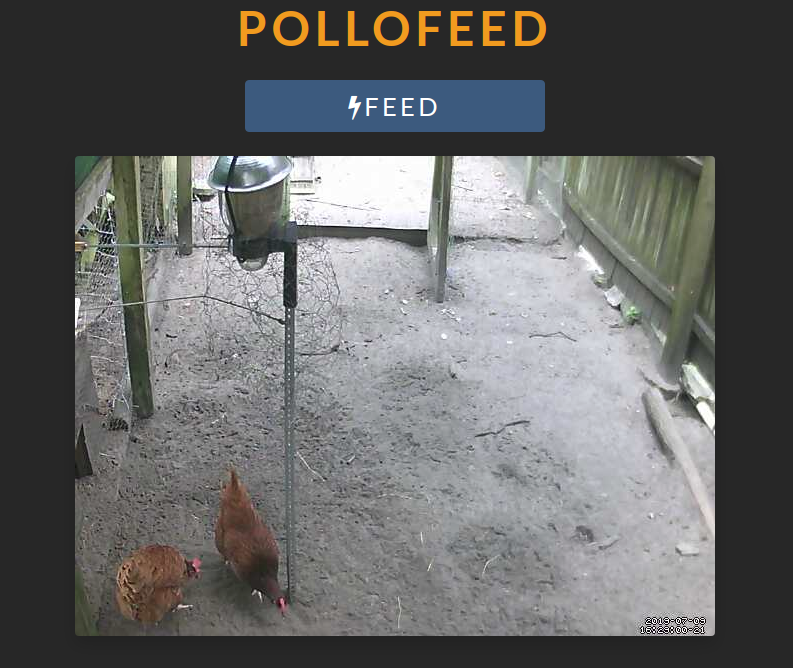

One of our favorite examples of the new capabilities that Lightning enables is Pollofeed.

At first sight this seems like a trivial application – feeding chickens over the internet. But on a deeper level, it demonstrates how money-as-software, when combined with existing software and hardware, extends the development of new permissionless capabilities.

In this example, a user sends a packet of data (bitcoin over the Lightning Network) which releases a small amount of chicken feed because it is a unit of value. This transmission can happen across continents, and it’s all viewable over live stream.

The takeaway is that micropayments won’t just be e-commerce with crypto, they will enable new applications that don’t exist today.

New technology is often simply a recombination of prior advances. Cameras existed before the early 1990’s and transmission of digital data existed before the early 1990’s. once these seemingly independent technological advances were combined we entered an innovation boom.he addition of micropayments to the myriad of technological assets we already have at our disposal could have the same effect. Pollofeed is just robotics and webcams, but now with value transfer.

Building on the foundations of Bitcoin

The Store of Value phase for crypto assets is becoming increasingly well established. There is a large installed ownership base of crypto assets, dominated by bitcoin, which now has tens of millions of users.

For Bitcoin specifically, the value of this installed base is increasing over time through deflationionary supply/demand dynamic. Historically, with every wave of adoption, distribution becomes more dispersed and value increases logarithmically.

Bitcoin owners experience their holdings being charged with value. Increases in the Bitcoin network value represent a store of monetary energy just waiting to be used.

The rise of mediums of exchange and crypto payment enabled businesses

Although merchant adoption of crypto has been slow to this point, there are good reasons to believe that we are on the cusp of a new phase in crypto in which it will enable more digital native economic activity when combined with existing capabilities.

The dawn of this phase is marked by two major developments:

-

The size and dispersion of the installed base of crypto ownership

-

The rise of medium of exchange technical solutions

Prior attempts to kickstart crypto as a medium of exchange appeared to have failed in part because of high fees and slow transaction times. Developments to solve these problems mean we are now on the verge of near-instant transaction times and micropayments. The Lightning Network is currently the solution with the most traction on Bitcoin, but there are other efforts underway such as Raiden and StarkPay.

Where will it begin?

Adoption by traditional merchants has been an ongoing focus for crypto. But cryptocurrencies face many challenges in replacing fiat money as we currently use it. Most economic activity is still denominated in fiat and there is still friction in transacting between fiat and crypto. What is more realistic and exciting is digital economy activity that is uniquely enabled by permissionless, programmable, peer-to-peer, digital micropayments.

We believe a major theme will be gaming. Gaming could be a perfect use case for crypto:

-

Games are natively built from software and depend upon hardware gamers are familiar with (a GPU mining rig is essentially a gaming rig)

-

The concept of digital assets and digital value are already second nature to the cohorts of Gen Z and Millennials – they grew up gaming on the internet.

-

The economic activity of players sending micropayments back and forth between each other can create the closed economies in which crypto can prove it’s worth by enabling unique activity, instead of trying to replace typical fiat economic activity.

It’s already starting to happen.

For example, GTA launched an in-game casino which accepts real cash in exchange for virtual currency, but use cases and withdrawals are strictly limited. Economic and game outcomes are already starting to merge via esports.

By integrating bitcoin, you have an in-game currency that is fully under the control of the user and interoperable with other games and fiat exchanges. A good early demonstration of this concept is the Lightning street fighter game from Mandel Duck studios.

Play as a #HongKong protester and if you win — get Satoshis! @zebedeeio #bitcoin #lightning @LNconf pic.twitter.com/q1XaUiI4jr

— Mad Bitcoins (@MadBitcoins) October 19, 2019

Instead of earning in-game points, players are exchanging Satoshis between each other as they trade blows. As well as pure competition, there is now a financial incentive built into the gameplay.

This is cool, but still a primitive example of plugging Lightning into an existing game concept. We’re excited about the new concepts that will evolve, perhaps extending to entire MMOG economies built on real financial incentives.

Looking forward

Gaming is just one clear potential application. We also want to see more of those really unique things, like Pollofeed, that might be born using second layer solutions and are totally unexpected. We see second layer micropayments enabling massive open online payments in both directions: many-to-one and one-to-many.

-

Many-to-one: Everyone around the world makes small contributions to fund one thing at the same time - not for investment purposes but instead focused around consumption, like Kickstarter on steroids and targeted at digital goods and services. Extensions might include creative works like video streaming, or API data streaming of various types.

-

One-to-many: Perhaps even more exciting if regulatory burdens don’t get in the way. Payments transferring from one source to a huge number of users include open source software development, crowdsourced information models, and universal basic income projects.

We have already started to see similar concepts built entirely on Turing complete smart contract platforms. The point is that not every application needs to be completely decentralized. For some use cases, it is enough that just the payment system is.

That’s why we’re excited to announce that Collaborative Fund is leading a funding round for ZEBEDEE, founded by Simon Cowell, Andre Neves and Christian Moss.

ZEBEDEE is building the development tools and infrastructure to allow easy integration of Bitcoin and Lightning into digital gaming environments. You can read more in their announcement here.

We look forward to the emergence of businesses that generate revenue and are uniquely enabled by a programmable peer-to-peer digital currency. If you’re building something interesting around second layer solutions, we’d love to hear about it!

By: Stephen McKeon and Simon Cowell