What We’re Reading

A few good pieces the Collaborative team came across this week …

Security

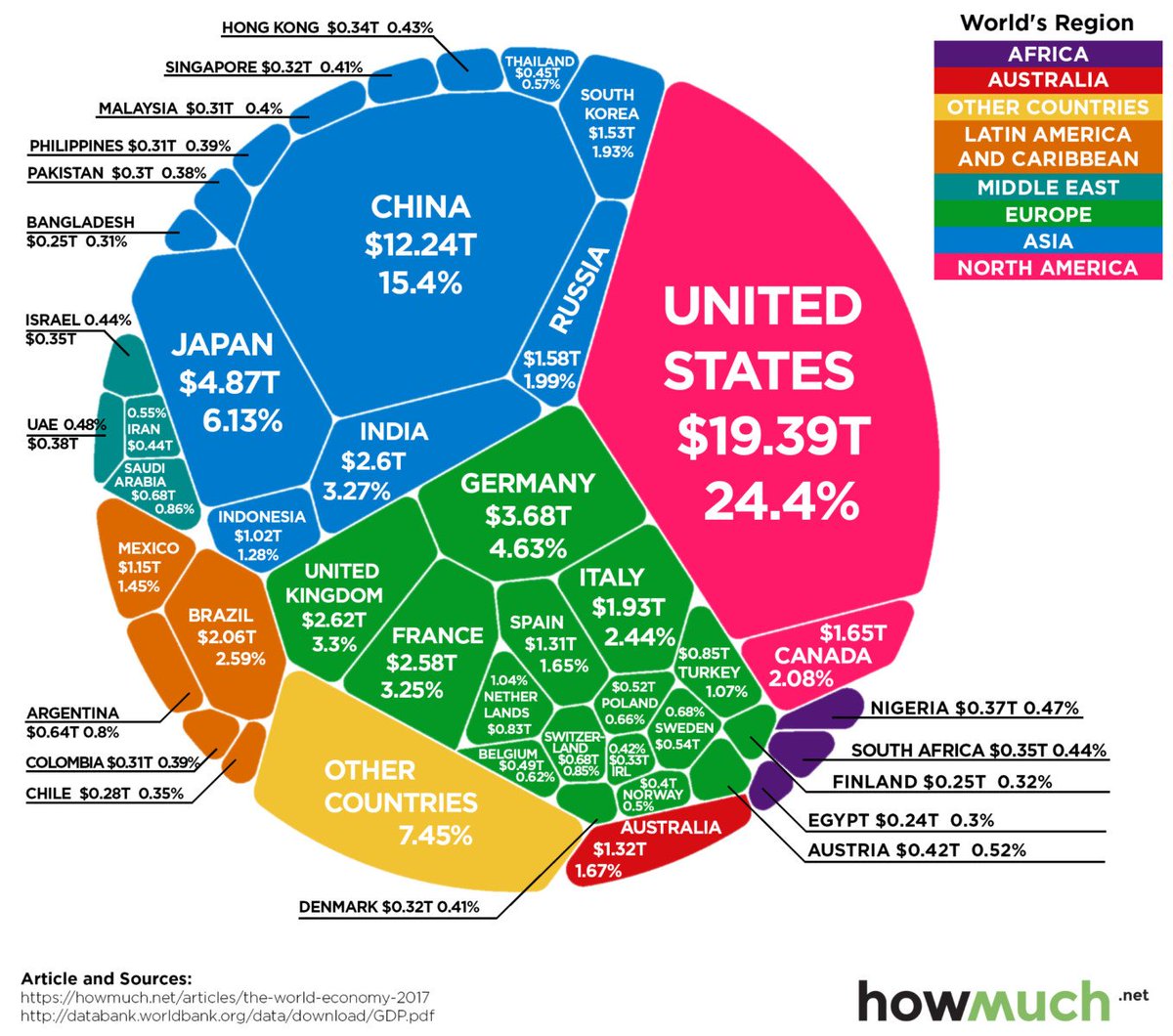

Virtually no one feels completely secure in their ability to keep the money coming in. The pace of technological change might not be much different than it’s always been in post-war America, but it’s undeniable that the signs of it have become more ubiquitous. The five biggest companies in the world are all technology companies that assassinate middlemen in every industry vertical. The middle class in my neighborhood is a muddled mix of technologically disrupt-able middlemen and professionals on the run from machines that grow increasingly capable with every software update. Having two to three times our current wealth might not be necessary today, but it sure would be a nice insurance policy against the uncertainty of the future.

Fear not

“Fear sells. Fear makes money. The countless companies and consultants in the business of protecting the fearful from whatever they may fear know it only too well. The more fear, the better the sales.” That short summary from The Science of Fear, by Dan Gardner, is perfect. Gardner goes on to recount how post-9.11 fear dramatically reduced air travel and led to many, many more driving trips. However, if a 9.11 impact attack had happened *every single day *for a year, the odds that you’d be killed by such an attack would be one in 7,750, still greater that the *actual *odds of dying in a traffic accident, which are one in 6,498.

Luck

Ask medieval historian Michael McCormick what year was the worst to be alive, and he’s got an answer: 536. Temperatures in the summer of 536 fell 1.5°C to 2.5°C, initiating the coldest decade in the past 2300 years. Snow fell that summer in China; crops failed; people starved. The Irish chronicles record “a failure of bread from the years 536–539.” Then, in 541, bubonic plague struck the Roman port of Pelusium, in Egypt. What came to be called the Plague of Justinian spread rapidly, wiping out one-third to one-half of the population of the eastern Roman Empire and hastening its collapse, McCormick says.

Makeup

Customers

The DNVB space wreaks of high customer acquisition costs and smells like a bubble. As Chamath Palihapitiya, the former VP of Growth at Facebook, and now the CEO of Social Capital, observed about $0.40 of every VC dollar raised goes straight to user acquisition:

“User acquisition and growth has become such an entrenched part of the Silicon Valley zeitgeist. Unfortunately, today’s massive venture-backed advertising, sales, and user acquisition playbook has morphed into one that champions growth at any cost.

We have higher salaries, higher rents, higher customer acquisition costs, Kind bars, and kombucha on tap!”

Surge

Wow:

The percentage of seniors who said they had vaped within the past 30 days — an indication of more frequent use — just about doubled, rising to 21 percent in 2018 from 11 percent in 2017.

Shaming

Wild:

Have a good weekend.