What We’re Reading

Here are a few good articles the Collaborative Fund team came across this week.

Keeping customers happy

This Tren Griffin post on churn is a must read:

Often the math of the unit economics produces a result that makes clear that the benefits of retaining a customers are nonlinear. In short, investments in churn reduction (retention) can yield a far better return on investment than generating new users on a relative basis. There are some research studies that claim that increasing customer retention rates by 5% can increase profits by 25% to 95%.

Expectations

Sam Altman on navigating middle-stage success is predictably great:

Raising too much money or raising money at too high a valuation can severely limit your optionality. Very often I’ve seen cases where founders know in their hearts they have an airplane but are able to convince good investors it might still be a spaceship. This really causes a lot of heartache, and often precludes your opportunity for a good acquisition later.

Returns

The Larry Fink annual letter rails against short-term thinking:

Companies have begun to devote greater attention to these issues of long-term sustainability, but despite increased rhetorical commitment, they have continued to engage in buybacks at a furious pace. In fact, for the 12 months ending in the third quarter of 2016, the value of dividends and buybacks by S&P 500 companies exceeded those companies’ operating profit. While we certainly support returning excess capital to shareholders, we believe companies must balance those practices with investment in future growth. Companies should engage in buybacks only when they are confident that the return on those buybacks will ultimately exceed the cost of capital and the long-term returns of investing in future growth.

Focus

Some interesting thoughts on Warren Buffett’s personality:

In some ways, Buffett was the archetypal absent-minded professor, so locked inside his own head that he wasn’t always aware of what was going on around him. (He says he doesn’t recall the color of the walls of his bedroom or his living room.) This could be hard on the people around him. “Physical proximity with Warren doesn’t always mean he’s there with you,” Susan says, in an old “Charlie Rose” interview. His children reiterate this sentiment. His son, Howard, says that it’s difficult to connect with Buffett on an emotional level, “because that’s not his basic mode of operation.” Susie, his daughter, says that you had to speak to him in sound bites, because if you went on for too long you would “lose him to whatever giant thought he has in his head at the time.”

Leverage

Bryce Roberts on companies crushing it on their own:

The biggest disruptive threat to venture capital is not crowdfunding or Angel List or hedge funds.

No.

The biggest disruptive threat to venture capital is when the very best founders realize they need very little of it to scale.

Shifts

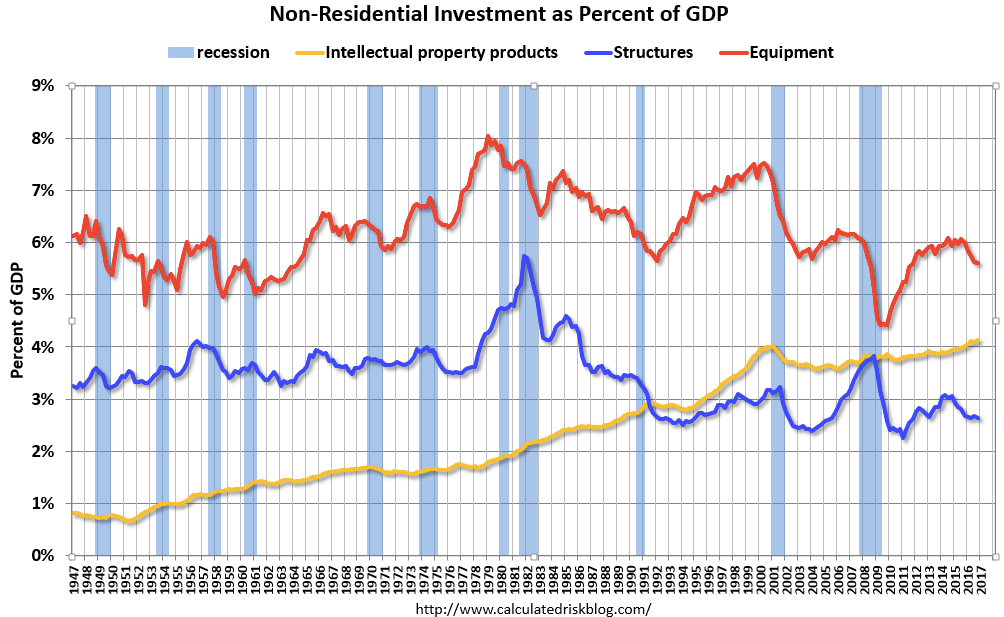

This chart explains a lot of the last 30 years: Investment in stuff is way down, investment in ideas is way up:

Have a good weekend.