How Warby Parker, Casper, and Dollar Shave Club Are Inspiring a New Generation of Entrepreneurs

By nearly any metric, it’s never been a better time to launch a consumer products company. M&A is at an all-time high. Funding has increased 8x since 2011. Consumer values are shifting too fast for big brands to keep up. Social networks have facilitated inexpensive viral marketing campaigns. And the proliferation of e-commerce has slashed distribution and overhead costs.

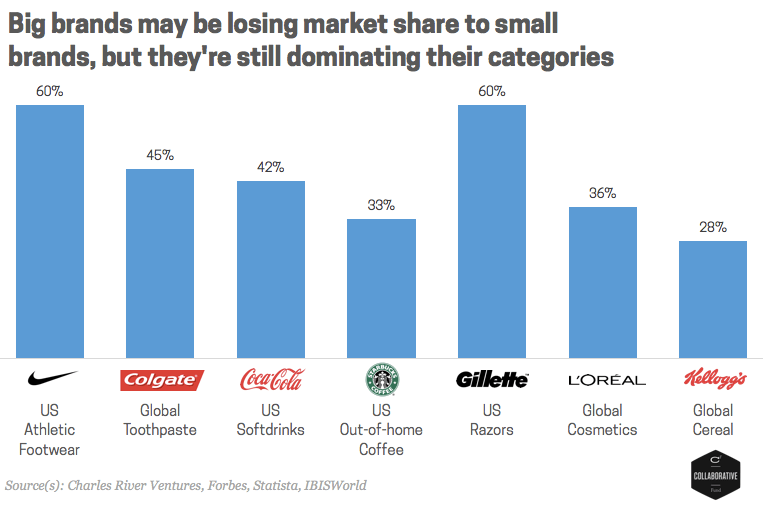

But growing a consumer products company isn’t easy. Big brands may be losing market share to smaller brands, but they’re still very much the dominant players in their categories: Nike, Gillette, and McDonalds still own 60% market share in athletic footwear, razors, and fast food, respectively.

And these companies spend fortunes to maintain supremacy in the mind of the consumer. The three biggest CPG companies in the world spent a combined $40 billion on marketing in 2015. While those massive budgets are becoming less meaningful as social media and online reviews supersede TV and print ads, they’re still sizable enough to prevent all but the savviest of startups from breaking through.

In order to compete against these giants, entrepreneurs can learn from the innovative underdogs who previously took a bite out of big brands – as Dollar Shave Club and Warby Parker did with Gillette and Luxottica – and paved new paths to success. There are oversimplifications and overlaps – no company can attribute success to a single strategy, after all – but here are a few key lessons from some of the most successful consumer startups of the past decade.

TOMS Shoes

Lesson Learned: Social Mission

TOMS pioneered the one-for-one model, donating a pair of a shoes to a child in need for every pair purchased, and ushered in a new era of socially conscious consumer products. The company’s success – Bain Capital acquired a 50% stake in 2014 at a whopping $625 million valuation – proves how much consumers value not just social responsibility, but explicit social missions. According to Nielsen, 55% percent of global consumers are willing to pay more to companies committed to positive social and environmental impacts – a 10% increase since 2011. Now, ten years after TOMS was founded, explicit social missions are practically par-for-the-course for successful consumer startups. In fact, the next company on our list, Warby Parker, employs a nearly identical one-for-one donation program to the one that TOMS popularized.

Warby Parker

Lesson Learned: Vertical Integration

Vertical integration – selling singularly branded products directly to the consumer – is not a new concept. Retail companies like Pottery Barn and The Gap have been using the strategy to reduce wholesaler waste and create memorable brands for decades. But Warby Parker was one of the first startups to extend the idea to a smaller, more specialized category, bypassing retailers and selling eyeglasses directly to the customer at significantly reduced prices. By applying this model to a new category, Warby Parker helped pave the way for other startups (including many of the names on this list) to use the direct-to-consumer model for everything from snack food to mattresses. Now, the days of retail mark-ups at stores like LensCrafters and Sleepy’s appear numbered.

Casper

Lesson Learned: Digitally Native

In less than two years, Casper demonstrated that customers were willing to trade tactile testing for the convenience and lower prices of online shopping, even for old-fashioned categories like mattresses. Casper certainly wasn’t the first company to focus on e-commerce as a primary channel, but it applied the model to a category that previously relied heavily on retail space. Of all the products customers want to test out in person and which are cumbersome to ship and return, mattresses are pretty high on the list, but Casper circumvented these issues with their 100 night trial program and “bed-in-a-box” shipping system. Casper’s success has shown that there are no limits to digital nativity and other products that once seemed to require physical stores – like sofas and bicycles – have eagerly followed suit.

Dollar Shave Club

Lesson Learned: Convenience

Dollar Shave Club applied the digitally native, direct-to-consumer model to the razor industry, cutting out drugstores and undermining industry leader, Gillette. And they took it one step further by offering a subscription service that delivered those razors directly to a customer’s door right when he needed them. Consumers increasingly value convenience over complexity, and DSC capitalized on this preference by providing cheaper and simpler razors with a no-brainer delivery model. This focus on convenience was validated when CPG giant Unilever acquired the company in July 2016. Now, startups in other personal care categories, from toothbrushes to body wash, have followed DSC’s lead by offering convenient packaging, delivery, and repurchasing options.

Hampton Creek

Lesson Learned: Strong unit economics

Hampton Creek’s plant-based products aren’t just sustainable and healthier than traditional egg-based staples, they’re also significantly cheaper to produce. Harvesting plants to create mayonnaise or cookie dough is a lot simpler and less expensive than raising chickens for eggs. With this lower production cost, Hampton Creek has found the magical intersection of health, sustainability, taste, and price. Because unit economics are so vital to scalability for consumer products, future CPG entrepreneurs need to find inventive means of reducing production costs while still aligning with consumers’ values.

The Honest Company

Lesson Learned: Non-toxic and eco-friendly

Jessica Alba launched The Honest Company in 2011 after her daughter developed an allergic reaction to popular household cleaning products. The Honest Company’s mission to offer non-toxic and eco-friendly alternatives has resonated with consumers, particularly parents, looking for simple, inoffensive ingredients in their household products. Now the company has expanded its product line to include, among others, diapers, vitamins, and beauty products. While THC has recently come under fire for its products’ effectiveness and labeling, the company’s $200+ million in revenue last year demonstrates that customers are clamoring for products that align with their values, and emerging startups should take note.

Blue Bottle Coffee

Lesson Learned: Aspirational

Like trends towards craft beer and artisanal ice creams, the “third wave” coffee movement, led by Blue Bottle, has emphasized quality above all else. From its stylish packaging to its stringent quality controls, Blue Bottle Coffee has created an aspirational brand in direct contrast with “for-the-masses” chains, like Starbucks or Peet’s Coffee, which were staples of the second wave. As stated in Rabobank’s Dude, Where’s My Consumer?, “Brands and product segments that were built by targeting blue collar, working class values—so prominent just a few decades ago—are now falling out of favor, as the U.S. consumer has become increasingly affluent, educated and white collar […] which has led to a democratization of premium consumption trends.”

Everlane

Lesson Learned: Transparency

Everlane, a minimalist online apparel company, has generated over $100 million in revenues and earned a $250 million valuation with relatively little financing – just over $1 million according to data from CB Insights. With detailed diagrams of their supply chain and production costs, Everlane brought radical transparency to the clothing industry just as fast fashion brands like H&M and Zara came under fire for their poor quality and questionable manufacturing practices. Consumers are becoming increasingly educated in their purchasing decisions and want to know exactly what goes into their products, how those products are made, and what kind of impact a company is going to have on the world.

Learn from the Past, but Try Something New

Financing, production, and M&A environments are all ripe for more innovation in consumer products, but the next generation of startups will not only be competing with dominant big brands and their sizable marketing budgets – they’ll also be competing with each other.

As barriers to entry have lowered, the number of consumer products has multiplied, and competition among startups has heated up. So while it’s helpful to learn from previous successes, the next generation of entrepreneurs can’t just mimic old models – they’ll have to build on these lessons by innovating brand new strategies and product categories never seen before.