Risk-Based Care

There are few things as hard to move as the US healthcare system. It’s a $3T+ giant held at rest by a broken business model: fee for service.

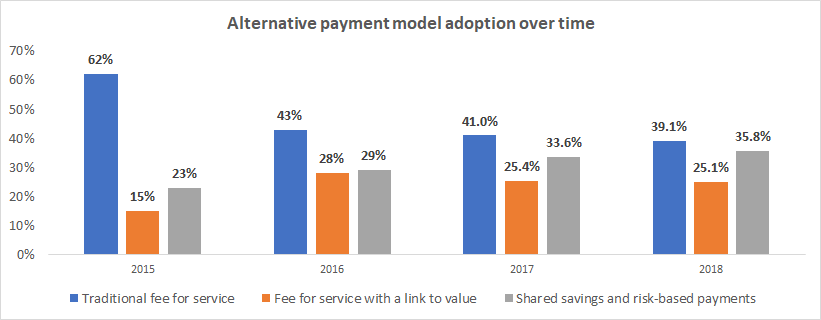

A growing consensus says the solution is value-based care — a system where providers are paid based on patient health outcomes rather than the volume of services they deliver. I agree that the best shot we have of aligning incentives between payers, providers, and patients is a radical new payment model. But I think of value-based care models as a halfway point rather than the destination. Adoption of early value-based care models is worthwhile insofar as they get us closer to risk-based care, where providers get an upfront fee for each patient and then are responsible for covering the costs of caring for that patient.

This isn’t the first time we’ve tried to reform how we pay for healthcare by pushing the responsibility and rewards of improving health outcomes onto providers. In the 1990s, managed care organizations emerged as the solution for cost containment. This most recent generation of value-based care models trace back to the earliest days of the Affordable Care Act. While many have been in market for over a decade now, they aren’t really working yet – adoption and evidence to support cost-savings have been slow to emerge.

Value-based care now covers a range of payment models. Some are toothless, like payment for performance: modest bonuses for providers that hit performance targets. These are fundamentally tied to a fee for service (FFS) model, with providers receiving higher payments for performing more service. Others are relatively drastic and only just starting to gain traction, like shared or full risk models. With risk-based payments, providers have more upside potential for reduced costs of care but are also responsible for the difference if costs exceed more than their targets.

Source: Healthcare Payment Learning and Action Network

There’s not much data on risk-based payments broken out from shared savings – the payment model is that uncommon. So far, most providers have opted for payment models where they have no downside. Unfortunately, arrangements where providers have nothing to lose, haven’t meaningfully shifted incentives nor behavior. Healthcare spending has continued to grow.

In a risk-based care environment, providers have the freedom and resources necessary to reduce the cost of care via investments in preventive services. Plus, they stand to benefit from the upside of reducing the variable costs of care.

A few factors that I think will motivate a critical mass of providers to adopt risk-based payment models this time around include:

-

Payers’ cost containment strategies –- Rising healthcare prices show no signs of slowing, and shifting demographics to an aging population make this arguably the most expensive problem in America. Private health plans and government payers alike have sought cost containment by limiting FFS reimbursements, forcing providers to look for growth via alternative payment models.

-

Competition – Incumbent health systems and provider groups are facing intensified competition on all sides – with payers building out their own care teams and retailers (like Walmart, CVS, etc.) moving to address low-acuity conditions with much more convenient care settings.

-

Technological advances – 10 years since the Obama Administration passed the HITECH act, allocating ~$30B to incentivize EHR adoption, and health data has finally been digitized. Plus, with the dissemination of cheap sensors, more health information is created and stored than ever before. We are steadily advancing to a point where this information can be readily exchanged and used to build health applications that automate much of the measurement, prediction, and preventative interventions that would otherwise fall to providers. And eventually this data storage and exchange ecosystem can reduce the reporting and reimbursement burden for providers that want to accept full risk for their patients’ health outcomes.

-

Proven models of success – Providers looking to transition to alternative payment models need only look at examples like Oak Street Health. These providers have achieved remarkable success in reducing spend and mortality among their patients, with some claiming up to a 50% reduction in inpatient admissions and a 52% decrease in ER utilization.

I believe we’ll get to a future where risk-based care is the norm. Until then, there is a massive opportunity for new companies to take advantage of the policy and technology shifts that major health systems are slow to adapt to. These could be full-stack providers seeking to take care of the health needs of entire populations – like Cityblock Health – or a specialty service that focuses on one particular condition – like Strive Health does for Kidney Care.

I also see white space for companies that help existing providers start to take on downside risk with services like negotiating with payers, augmenting their practices with new data products and analytics, or extending their workforce to address social determinants of health.

If you have thoughts on how to accelerate the uptake and impact of risk-based payment models, we’d love to hear from you!