What We’re Reading

Here are a few good articles the Collaborative Fund team came across this week.

HR

Unsplash’s hiring page is quite good:

You’ve said you don’t want to see resumes. What do you want to see from someone applying for a job at Unsplash? Is it all about the portfolio?

Yeah, we think the traditional attached cover letter/resume with bullet points are an outdated, inhuman form of applying for a job. PDF resumes that we were taught to make in high school are artifacts from an economic time that aimed to turn people into replaceable cogs in a system. They reduce you to comparison. They strip you of your personality and what makes you unique, which is precisely what we are looking for in a hire.

We want to see what you do when you’re not told what to do. Because that’s what it’s like at Unsplash. This is why we don’t have a hiring form on our Hiring page. Instead, we ask you to just send us an email. We leave it up to you to decide what to put in it.

Logistics

Amazon’s competitive dominance:

Since 2006, Amazon has reduced its total shipping cost by over 50% and increased its profit margins by between 5% and 14%, according to a working paper released Monday, authored by economists Jean-François Houde, Peter Newberry, and Katja Seim. Over the same period, prices at the online retailer have fallen by almost 40%, suggesting most of those savings in shipping costs are passed on to customers, they found separately.

Opportunity

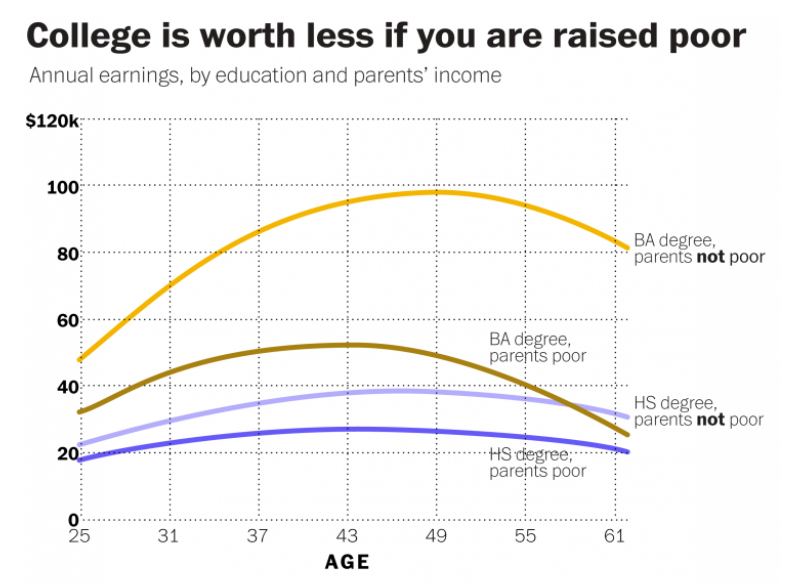

Your parents’ income has a big impact on your earnings regardless of your level of education:

Fragility

This is an amazing piece about how easy it is to spiral out of control when you’re poor:

I once lost a whole truck over a few hundred bucks. It had been towed, and when I called the company they told me they’d need a few hundred dollars for the fee. I didn’t have a few hundred dollars. So I told them when I got paid next and that I’d call back then. I finally made it to payday, and when I went to get the truck, they told me that I now owed over a thousand dollars, nearly triple my paycheck. They charged a couple hundred dollars a day in storage fees. I explained that I didn’t have that kind of money, couldn’t even get it. They told me that I had some few months to get it together, including the storage for however long it took me to get it back, or that they’d simply sell it.

I wound up losing my jobs. So did my husband. We couldn’t get from point A to point B quickly enough, and we showed up to work, late, either soaked to the skin or sweating like pigs one too many times. And with no work, we wound up losing our apartment.

It’s amazing what things that are absolute crises for me are simple annoyances for people with money.

Skills

Howard Lindzon shares his reading habits:

The number ONE question I get asked is what I read. My fantastic job IS to read. I am incentivized to read the right things. In some ways, my filters – what I DO NOT READ – may be even more important than what I do read…. My ultimate edge comes down to my eyes and ears, the network I have made, the people I work most closely with everyday, the wins, the losses and the long miles on the road to get face time with smart people.

Allocation

More mutual funds are funding private startups:

Thirty-six percent of firms going public in 2016 received mutual-fund financing before their IPO, according to a recent research paper by Michelle Lowry and Sungjoung Kwon, both at LeBow College of Business, Drexel University, and Yiming Qian at the University of Iowa.

This practice of investing in private firms has become increasingly widespread. Specifically, the authors say, fewer than 15 funds invested in private companies each year through 2000, compared with around 90 unique funds in 2015 and 2016.

Have a good weekend.