What We’re Reading

A few good articles the Collab team came across this week …

Economics

The restaurant industry hits a peak:

There are now more than 620,000 eating and drinking places in the United States, according to the Bureau of Labor Statistics, and the number of restaurants is growing at about twice the rate of the population.

“Everybody thinks their brand has what it takes to succeed in the marketplace,” said Victor Fernandez, an industry analyst with TDn2K, a Dallas-based firm that gathers data on the chain restaurant industry. “You look at a location that looks good, but everybody is looking at the same place and they all come in, and the result is you get oversaturation.”

Incentives

For seven months, just over a thousand Washington, D.C., police officers were randomly assigned cameras — and another thousand were not. Researchers tracked use-of-force incidents, civilian complaints, charging decisions and other outcomes to see if the cameras changed behavior. But on every metric, the effects were too small to be statistically significant. Officers with cameras used force and faced civilian complaints at about the same rates as officers without cameras.

Innovation

This is spot on:

The point of most innovations in consumer finance has been precisely to reduce its presence in our lives: Instead of talking to a bank teller to get money, you use an ATM. Instead of physically walking into a broker’s office to talk about which stocks to buy, you buy index funds through a web page. Or, now, you click to enroll in an app and it does all of your asset-allocating and stock-picking and tax-harvesting and so forth for you. I think that a lot of financial technology is heading in the direction of perfecting that vanishing act, so that in 20 years you’ll just think about financial things less than you do now.

Culture

Investor Howard Marks:

I told them a story that I got from a kids book when I was reading to my son that the sun and the wind are having an argument about which is more powerful and they can’t settle it. So they say, “Well, you see that guy walking along the mountain ridge? He’s wearing a coat whichever of us can get the coat off that guy is the more powerful.” The wind blows, and blows, and blows, and blows, and blows and the stronger blows the tighter the guy holds the coat. Then the sun shines his warming rays and the guy takes a coat off. It’s really just an example that business can be an incredibly positive place and we’ve had an incredibly positive experience. Sharing, and integrity, and straightforwardness, and as Bruce says putting the client first makes it incredibly rewarding. We’ve been successful professionally and monetarily but I think both of us would say that the greatest thing has been the opportunity to be successful on the higher route.

Value

Relevant to most public companies:

Encourage the companies you own to adhere to the golden rule of buybacks: A company should repurchase its shares only when its stock is trading below its expected value and when no better investment opportunities are available. Most executives think in terms of “growth versus nogrowth” rather than “value creation versus value destruction.”

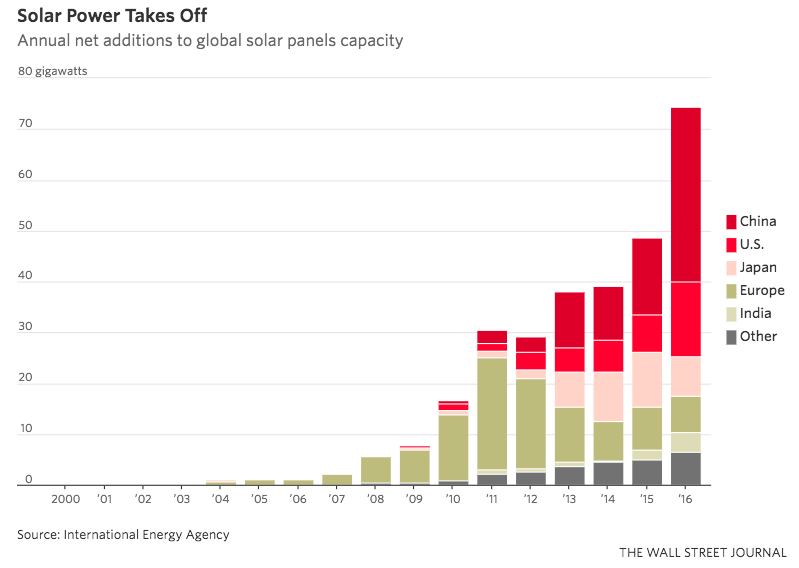

Growth

China is not messing around with solar:

Have a good weekend.